The Recent Rise in Driving: Blip or Trend?

Any growth in VMT in the future is likely to be slow by historical standards, and any growth in per-capita driving to be minimal.

The past year has seen a marked increase in driving in the United States. The number of vehicle-miles traveled (VMT) in the 12 months ending in February 2015 was 2.4 percent higher than in the 12-month period ending in February 2014, representing by far the fastest increase in VMT in a decade.

Back in 2011, we asked whether the decline in VMT that had then been occurring for several years represented a blip or a trend. It’s time to ask that question again: Is the Driving Boom in America really over? Or was it just on hiatus?

The recent rise in VMT certainly bears watching, but it is not enough to suggest that the nation is entering a new Driving Boom.

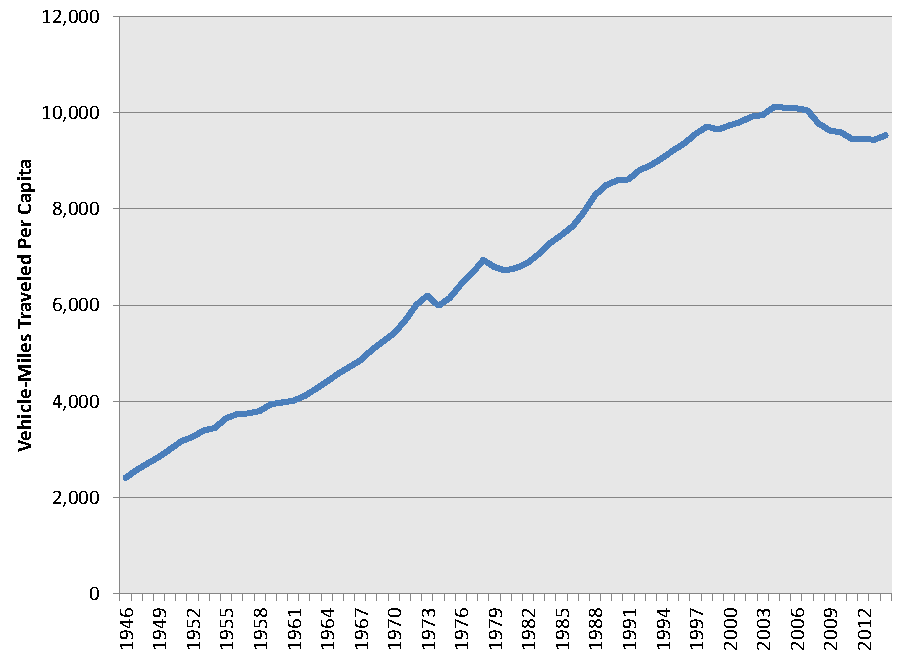

In our 2013 report, A New Direction, we argued that – as a result of many factors – the number of miles driven by the average American had probably peaked back in 2004, and that the future trajectory of total VMT could follow one of several paths depending on “wild cards” such as changes in technology, evolving housing and transportation preferences, and public policy decisions. Even with the recent uptick in driving, the average American still drives about 6 percent fewer miles than in 2004, with average VMT remaining at about the level it was at the beginning of Bill Clinton’s second term in 1997.[1] (See Figure 1.)

Figure 1. Per-Capita Vehicle-Miles Traveled, U.S.

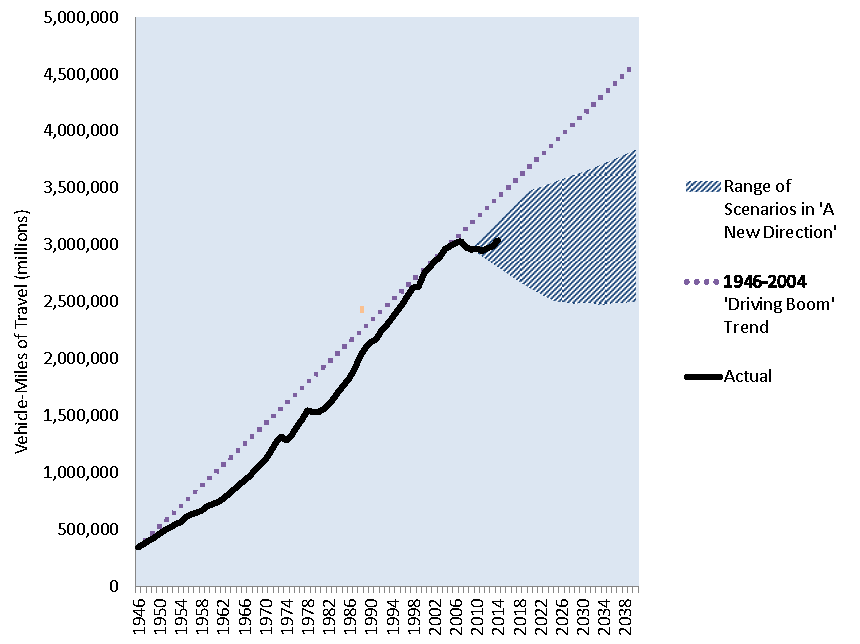

Total VMT remains well within the envelope of scenarios we evaluated for A New Direction and well below the trend line of the Driving Boom years. In 2014, Americans drove approximately 400 billion fewer miles per year than we would have had the Driving Boom-era trend continued. (See Figure 2.)

Figure 2. Total VMT versus Historical Trend and A New Direction Scenarios

VMT growth picked up steam beginning in the spring of 2014 and continuing through the first months of 2015. That period saw two big changes: 1) strong economic growth in the second and third quarters of 2014 followed by, perhaps more importantly, 2) plunging gasoline prices.

Between February 2014 and February 2015, gas prices fell by one-third. The rise in VMT during that period can be largely explained by the short-term response to falling gas prices.[2]

The question that matters for transportation policy, however, is how travel demand might change in the long run. Some of the short-term factors that fueled the run-up in VMT in late 2014 and early 2015 are already abating – economic growth has moderated and gasoline prices have increased by more than 50 cents since their low in late January. If current forecasts of moderate oil prices come true, we can anticipate somewhat more driving than might have been expected a year or two ago. But the surprise collapse of oil prices last fall should remind us to be wary of betting too much on any forecast of future oil prices.

Meanwhile, the deep societal shifts that made the Driving Boom as prolonged and durable as it was – rising participation in the workforce, rapidly growing access to vehicles, rapid improvement in the quality and availability of roads, rampant suburban sprawl – have not re-emerged, and some, it is all but certain, never will.

Light-duty vehicle sales have recovered from the recession but remain at roughly the levels of the late 1990s/early 2000s, when the U.S. population was significantly smaller. (The sustainability of even that level of sales is questionable given growing concerns about subprime auto lending.) The share of the driving-age population with a driver’s license continued to decline in 2013, the last year for which we have complete data.

Exurbs – which generate tremendous amounts of driving – are growing again, but not at nearly the rate at which they did in decades past. Single-family home construction remains way below long-term average levels while multi-family construction remains relatively high. Millennials continue to be in no identifiable rush to get married, have babies, and flee to the suburbs – despite the economic recovery – all conditions that might signal resurgent, prolonged growth in driving among that pivotal age group. The employment-to-population ratio, while up a tick from the recession years, is nowhere near regaining its historic heights of the late 1990s and early 2000s, and economists believe that, with the aging and retirement of the Baby Boomers, it likely never will.

In short, the increase in VMT that the U.S. has experienced recently is worth paying attention to, but unlike the Driving Boom years, when cheap gas was one of many factors that fueled ever-growing levels of driving, long-term trends such as shifting demographics and saturation of the market for cars and driving suggest that any growth in VMT in the future is likely to be slow by historical standards, and any growth in per-capita driving to be minimal.

Moreover, the “wild cards” we discussed in our 2013 report remain as wild as ever. The future housing and transportation behaviors of the Millennial generation – much less those of the emerging “Generation Z,” following hot on their heels – remain in question, as does the future direction of technology, which, with the growth of new shared-use modes and the impending arrival of autonomous vehicles, could take us in any one of a number of directions. Finally, there is the role of public policy. If we continue to provide massive (and growing) subsidies to driving and sink vast resources into highway expansion, the future trajectory of VMT is likely to be far different than if we invest instead in public transportation, walkable communities, and less auto-intensive forms of development.

Predictions are difficult, the physicist Niels Bohr is reputed to have said, especially ones about the future. In many places in the United States, we continue to justify big-ticket transportation projects based on how much we think people might drive 20, 30 or 40 years into the future. The experience of the past decade – both the largely unanticipated decade-long drop in per-capita driving and the recent surprise uptick – shows the folly of that strategy in an era of rapid change. We need to adopt a new approach: one that targets investments based on their ability to serve societal goals of efficiency, sustainability, resilience, and community health as opposed to forecasts of future demand that invariably turn out to be wrong.

[1] Based on year-end 2014 data from the Federal Highway Administration’s Traffic Volume Trends series of reports.

[2] Using estimates of price elasticity of demand compiled by the indispensable Todd Litman of the Victoria Transport Policy Institute (PDF), we can get a sense of how much of the increase in driving can be attributed to falling gas prices. Estimates of the short-run elasticity of VMT with respect to fuel price range from approximately -0.026 to -0.17, meaning that, for every 10 percent reduction in gasoline prices, one would expect VMT to increase by 0.26 to 1.7 percent. The 34 percent decline in gas prices between February 2014 and February 2015, therefore, would be expected to result in an increase in driving of between 0.9 percent and 5.8 percent, suggesting that gas prices have played at least a key supporting role in the recent boomlet in driving.

Authors

Tony Dutzik

Associate Director and Senior Policy Analyst, Frontier Group

Tony Dutzik is associate director and senior policy analyst with Frontier Group. His research and ideas on climate, energy and transportation policy have helped shape public policy debates across the U.S., and have earned coverage in media outlets from the New York Times to National Public Radio. A former journalist, Tony lives and works in Boston.