It Has Never Been Cheaper to Climb into an Expensive Car

For now, low interest rates, long loan terms and generous lease deals are enabling many consumers to get “more car” than they otherwise dreamed possible. But the intoxicating feeling of driving an exciting new car comes with a potential hangover down the road.

Other posts in the Mobility on the Installment Plan series:

by Vincent Armentano and Tony Dutzik

Loose loan terms, favorable interest rates and generous lease deals have altered the automobile market. For consumers looking only at monthly payments, a new car might appear to be as affordable as a used car did a few years ago, a large car as affordable as a small one, or a luxury car as cheap as a mid-market model.

Chances are that you’ve seen an advertisement lately offering you the opportunity to lease a new car with a ridiculously low upfront payment or monthly cost – or to buy a car at a 0 percent interest rate. Edmunds.com, for example, compiled a long list of deals in this September story with monthly payments around $199.

Such low monthly payments make car ownership appear more affordable, and lure consumers into more expensive cars. The Detroit News recently interviewed the owner of a Milwaukee-area car dealership, who explained that “because interest rates are low and more lenders are willing to extend the payback period and reduce the monthly cost, consumers are buying ‘a little more expensive car from us.’”

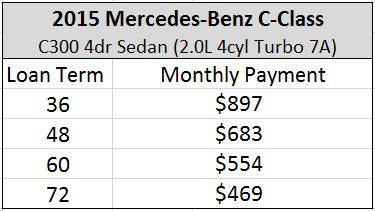

Looking at how these changes in credit markets affect the monthly payments for luxury vehicles provides an interesting window into how they affect the economics of car buying overall. Let’s look at a new 2015 Mercedes-Benz C-Class, a luxury vehicle by any measure, which comes at a price of around $38,000 MSRP. Assuming an interest rate of 3 percent (not unusual today for a borrower with good credit), with a 20 percent down payment, and a 48-month loan, the vehicle could be had for a monthly payment of about $683 per month according to Edmunds.com.

The monthly payment can be reduced by extending the repayment term of the loan. In the example below, going from a traditional 48-month loan to a 72-month loan (also increasingly common today), reduces the monthly payment by 40 percent.

Data: Edmunds.com

Leasing a vehicle can drive the monthly payment down even further. Searching on Edmunds.com for a standard three-year lease on our Mercedes C-Class, we’re shown a monthly payment of $442 without an initial payment or $319 with a typical initial payment. For consumers who are looking solely at the monthly payment as their measure of affordability, low interest rates, longer loan terms and leasing are working together to change consumers’ ideas of what is affordable.

The effects of this shift in the market for automobiles can be seen in a variety of places. For example, the past 5 years have seen a resurgence in SUV sales, which now represent 56% percent of new car sales, up from 48% in 2009.

Climbing into a car that you might not otherwise be able to afford is a seductive idea, but it comes at a cost. For those who lease, the end of a lease period leaves the consumer holding nothing of value, as opposed to a vehicle that can fetch value in a trade. For those who pay off auto loans over a longer term in order to lower a monthly payment, the danger comes in higher overall interest payments over time, as well as spending much of the term of the loan “underwater” – owing more on the vehicle than it is worth. Being underwater limits the options of consumers who might want or need to sell a car before the loan period is up, leaving them responsible for paying off the balance of the loan or tempted to simply roll the balance into a new car loan, digging themselves deeper into debt.

For now, low interest rates, long loan terms and generous lease deals are enabling many consumers to get “more car” than they otherwise dreamed possible. But the intoxicating feeling of driving an exciting new car comes with a potential hangover down the road. How serious that hangover will be – for consumers and the auto industry – and when it will kick in, both remain to be seen.